About Landquire

LandQuire is a proptech specializing in data analysis, leveraging open data in the United States to identify and structure the best real estate opportunities using a proprietary algorithm.

Rather than an investment fund, LandQuire offers directly high-potential operations to private private investorsby acquiring and developing land (urban planning, servicing) before reselling it to developers. Result: short short investment cyclesgenerally from 18 to 36 months.

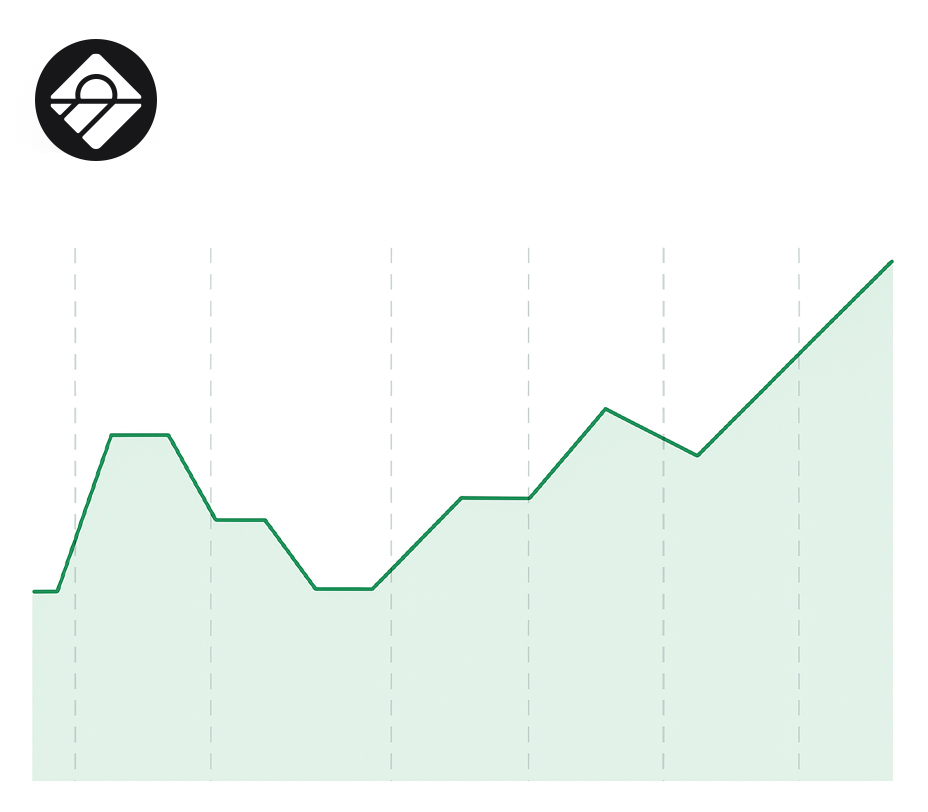

With over 1,000 successfully completed, 130 deals financed since 2021, and a over $40 million raised from more than 600 investorsLandQuire is a major player in the American land market. Headquartered in Miami, the company relies on teams spread across the United States, Mexico, El Salvador, Bangladesh and France, bringing together a variety of skills in acquisition, data science, engineering, finance and investor relations.

Our History

LandQuire was born of a simple conviction: the future of real estate investment lies on the land.

Created in 2021 by Romain Daniellou and Thibaut Guéanttwo French entrepreneurs based in the United States, LandQuire has rapidly established itself as a leading player in high-yield land investment.. A specialist in "land entitlementour company identifies raw land with high potential in fast-growing areas - mainly in Texas - and and enhances their value by obtaining all the necessary authorizations to make them ready to build on..

Our ambition is clear: to make LandQuire the leader in land investment in the United States, by combining the power of data, regulatory expertise and a unique network of local land players. We firmly believe that land is a tangible, rare and strategic asset - and that, properly invested, it can become one of the best-performing pillars of a portfolio.

An approach based on on the data

Thanks to a proprietary algorithm and the analysis of more than 120 criteria per field, our teams continuously scan the 3,143 U.S. counties to identify the best off-market opportunities. This strategy enables us to generate 2 to 3 opportunities per week with strong potential for added value, while optimizing our lead times thanks to targeted intervention on the first phase of the project (purchase and servicing).

A model transparent and partnership

Unlike traditional funds, our investors participate directly in concrete projects through dedicated companies (SPVs). This enables them to maintain controland benefit from total transparency and enjoy an average annual return on investment of 22%. So you can choose exactly which operations you want to be involved in.

Rigorous selection projects

We select only highly liquid land high liquidityin areas of sustained sustained demographic growth and compatible with profitable subdivisions. Each plot is analyzed according to criteria of profitability, accessibility, natural risks and compliance with urban policiesin line with our ESG objectives (environmental impact, resource conservation, etc.).

A team of trust

LandQuire relies on an experienced experienced, multicultural and complementary teamteam, bringing together experts in real estate, engineering (in partnership with LJA Engineering), data science and financial management. Our privileged relationships with local authorities enable us to accelerate administrative processes and secure our exits, a guarantee of reliability for our investors.

Our commitment for investors

At LandQuire, the security of our investors is at the heart of our mission:

- The land is owned outright by the SPVs.

- Every project is covered by insurance.

- In the event of delays or unforeseen circumstances, we give priority to reallocating profits to our investors. If a project is not sold within 60 months, LandQuire undertakes to return 100% of profits to investors.

- A dedicated portal provides real-time monitoring of each project, ensuring total transparency. Via this portal you have access to quarterly reports on each project, as well as a monthly report on all LandQuire departments.

Our ambition

By 2026, LandQuire plans to invest 100 million dollars in large-scale operations to help solve the housing crisis in the United States, particularly in Texas, where the market is particularly dynamic.

We are convinced that land is a tangible, resilient and profitable asset and that our approach, combining technological innovation, long-term vision and operational excellenceis a unique opportunity for discerning investors.