TEXAS MINING RIGHTS: WHAT EVERY BUYER NEEDS TO CHECK

Investing in Texas: the importance of verifying your mineral rights

Did you know that in Texas, you can buy land without owning the mineral rights? It's a surprising and costly reality for many buyers. According to a 2024 Texas Real Estate Commission analysis, nearly 40% of real estate transactions involving rural land fail to transfer full mineral rights, leaving the new owners in the dark or with no rights at all to the resources beneath their own soil.

LandQuire expertise

This article is brought to you by LandQuire, a company specializing in land investment in Texas. Since 2021, we have supported over 400 French-speaking investors, with an average ROI of 22% per year on our projects. Thanks to a team of experts in real estate, data and land entitlement, we have structured several transactions representing millions of dollars in assets. Our mission: to secure your acquisitions by eliminating the risks associated with land entitlement.

The question every buyer needs to ask is simple: "What do I need to know about mineral rights in Texas?". The answer remains complex and crucial. Mastering Texas mineral rights is more than just a legal formality: it's the key to protecting the value of your investment and avoiding unpleasant surprises, such as seeing a drilling rig set up on your land. In fact, mining rights are often the most valuable asset in a transaction, and can be worth millions of dollars.

In this article, you'll discover the secrets of mineral rights in Texas. Together, we'll analyze the intricacies of the Texas legal system, explain how oil royalties work and give you a complete checklist for verifying your title. Our goal is to turn you into an informed buyer, able to navigate the Texas real estate market with confidence, from Houston to Dallas.

1. THE ABC OF MINERAL RIGHTS IN TEXAS: A HISTORY OF SPLIT OWNERSHIP

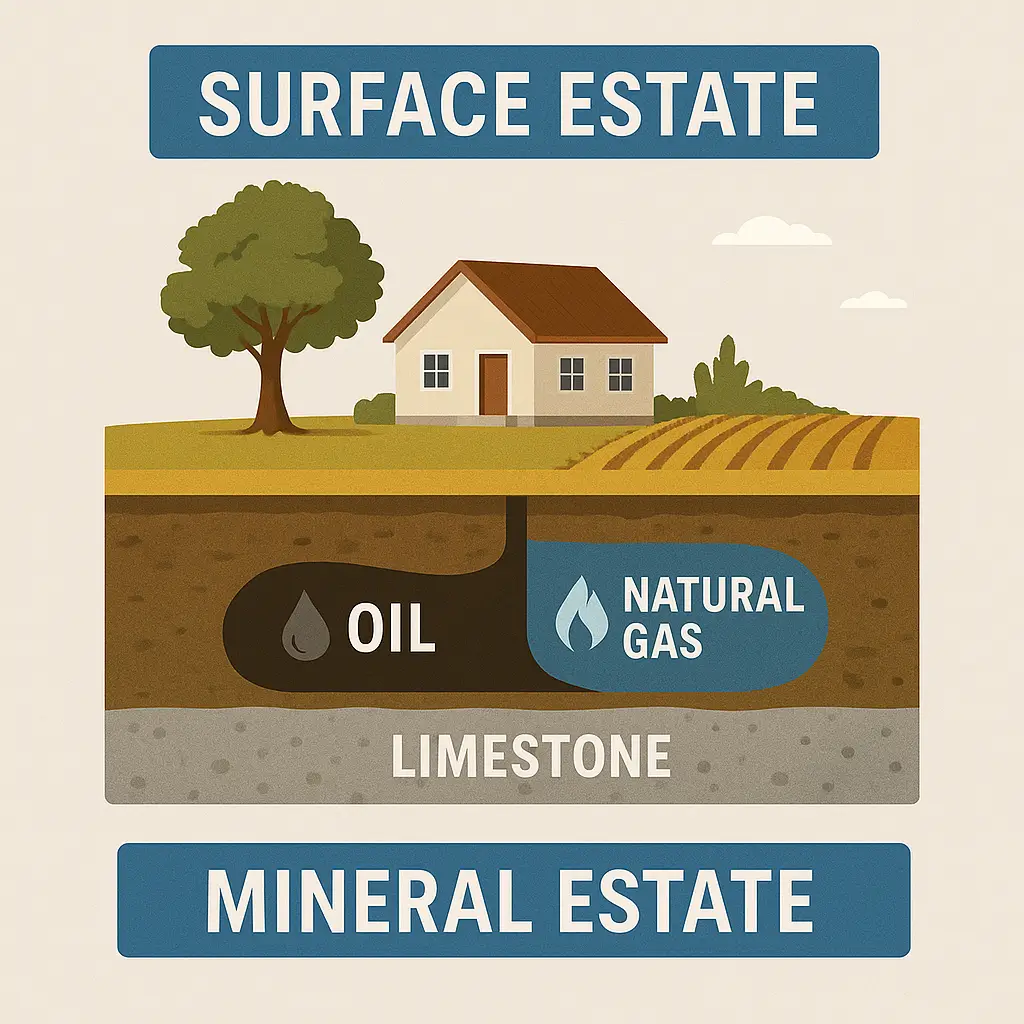

In Texas, land ownership works in a unique way. Unlike in many states, owners often divide land into two distinct "estates": surfaceestate and mineralestate. The former covers everything above ground: the land itself, buildings and crops. The latter gives the right to exploit, produce and receive income from minerals present underground, such as oil, natural gas, limestone or coal.

This division, often referred to as "Severed Mineral Estate", is the source of most confusion. When an owner sells his land, he can choose to :

- Selling surface and mineral rights together

- Sell the surface but retain all or part of the mining rights

- Sell the surface and transfer the mining rights to a third party

- Retain surface rights and sell mining rights only

To complicate matters, successive generations often fragment mineral rights, creating complex "chains of title". There are many parcels where dozens of owners, descendants of the same family, share mineral rights. That's why you should always examine the title carefully.

💡 Key points to remember about Texas mining rights

- Owners often divide land ownership into two parts: surface and mineral.

- When buying, the seller does not automatically include mining rights.

- Ownership of mining rights has a direct impact on the value of the property.

- Title verification is complex and requires expert help

2. UNDERSTANDING AND ASSESSING THE VALUE OF OIL AND GAS ROYALTIES

If you don't own the mineral rights, you won't be entitled to Texas oil royalties. Royalties are payments that oil and gas companies make to owners of mineral rights in exchange for exploiting the resources beneath their land. In general, royalties represent a percentage (often 1/8th or 1/4th) of gross revenues from oil or gas production.

FACTORS INFLUENCING ROYALTIES

- The value of royalties is not fixed. It depends on several factors:

- Royalty rate: The percentage of production that is paid to you.

- The price of a barrel of oil or natural gas: Revenues are directly linked to market prices, which are highly volatile.

- Well production: Wells have a lifespan. Production can vary over the years.

It is possible to assess the value of future royalties, but this requires expertise. This is a market in its own right, where buyers and sellers exchange royalty rights. If you're looking for Texas mining rights for investment purposes, valuing these royalties is the most important point.

🎯 Concrete action to evaluate royalties

- Request production statements and royalty payment slips for recent years

- Consult the Railroad Commission of Texas for public data on active wells in the region.

- Hire a mineral appraiser for an independent appraisal

Comparative table of rights types

| Type of right | Description | Royalty rights? |

|---|---|---|

| Mineral Estate | The right to own and exploit minerals. The owner can sign mining leases. | Yes |

| Surface estate | The right to own and use the surface of the land. | No (except by specific agreement) |

| Royalty Interest | The right to receive payments from production, without owning the minerals or having the right to operate. | Yes |

| Leasehold Interest | Temporary right to exploit a mineral. Often held by an oil company. | No |

3. THE MINING TITLE VERIFICATION PROCESS: THE CRUCIAL STAGE

Verification of the mining title is the most delicate and important step. It's not enough to look at the surface title. For Texas mineral rights, you have to trace the chain of ownership back several decades, sometimes to the original grant of the land by the state.

At LandQuire, we subject every project to strict due diligence. In 2024, we sold projects that generated an average ROI of 22%. We owe this performance to our mastery of mining title verification processes.

Why this complexity? With every transaction, people can separate, sell, bequeath or donate mineral rights. As a result, a title may contain restrictive covenants, active mining leases, mortgages or easements that are not visible on the surface title.

The process generally involves several stages:

- Record search: The specialist lawyer or "landman" (expert in mining rights) examines the land registers of the county where the property is located.

- Chain-of-title creation: They create a family tree of the property to identify all past owners and transactions.

- Checking mining leases: They identify existing leases and their clauses (term, royalties, etc.).

- Issuing a title report: They write a comprehensive report summarizing the status of the mineral property.

⚠️ Caution: The simplified verification trap

- Don't trust the real estate agent who assures you that "everything is included". A real estate agent does not have the expertise to verify mineral rights.

- Don't be content with a simple "title search" that only covers the surface property.

- A mineral title report is a separate document and must be ordered separately.

It's a long and costly procedure, but the risk of not doing it is even greater. Acquiring land with a defective mining title can lead to complex legal disputes and loss of investment value.

🎯 Considering a purchase in Texas?

Contact our LandQuire team for a personalized analysis of your mining rights and benefit from our expertise in land entitlement.

4. MISTAKES NOT TO BE MADE AND TIPS TO SECURE YOUR PURCHASE

Buying land in Texas, especially in resource-rich regions like the West Texas Permian Basin, requires a specialized approach. TheEnergy Information Administration (EIA ) reports that the Permian Basin produces more than 40% of America's oil, making it a major draw for investors and complicating their decisions. Even experienced buyers often make mistakes. Avoiding them is the best way to secure your investment.

COMMON MISTAKES TO AVOID

Mistake #1: Ignoring "mineralservitude" rights. A mineral lease authorizes a company to use part of the surface to access minerals, build roads, drill wells and install infrastructure, even if you own the land.

Mistake n°2: Neglecting to check active leases. A lease can remain valid for years, even when production temporarily ceases. When a lease is "in production", it continues indefinitely.

Mistake 3: Thinking that "water rights" are automatically included. These rights are not part of mining rights: you need to check them separately.

Mistake No. 4: Minimizing environmental impact. Minerals mining alters the soil and can contaminate groundwater.

HOW TO SECURE YOUR PURCHASE

- Work with local experts: Hire a Texas mining rights lawyer and a local landman. They know the local specifics and the judges.

- Draw up a precise purchase contract: The contract must clearly stipulate whether mining rights are included or excluded from the sale.

- Request a complete title report: Insist on a report that covers the entire chain of mineral title.

Step-by-step guide to Texas mining rights verification

Step 1: The sales contract

Make sure the contract includes a clause on mineral rights. It should specify whether the rights are fully transferred, partially transferred, or retained by the seller.

Step 2: The specialist lawyer

Hire a lawyer experienced in Texas real estate law and mineral rights. He or she will help you understand complex clauses.

Step 3: The title search

The lawyer or landman conducts the search and prepares a "Title Opinion" or "Drilling Title Opinion" confirming ownership.

Step 4: The deed

The Mineral Deed or Warranty Deed must be accurately drafted to transfer the mineral property. You must register it with the county clerk's office.

5. CASE STUDIES AND OUTLOOK FOR THE TEXAN MINING MARKET

Real-life testimonials

Testimonial 1: "We almost bought a large plot of land in the Midland area for a farming operation. The seller assured us that 'everything was included'. Fortunately, our lawyer insisted on a Texas mineral rights check. It turned out that an oil company had held the mineral rights since the 1950s. We would have bought land with no value on what was under the ground, nor royalties. We cancelled the sale. - Jean-Pierre T., Dallas real estate investor.

Testimonial 2: "I bought a parcel of land near Austin thinking it would be a good real estate investment. A few months later, an oil company began exploration. I discovered that I only owned a quarter of the mineral rights. With the help of a lawyer, I renegotiated an agreement, but my investment lost much of its value. The lesson: always check Texas mining rights!" - Maria R., land buyer in Austin.

Since 2021, more than 400 French-speaking investors have trusted LandQuire with their acquisitions in Texas. Our expertise in land entitlement and our rigorous due diligence process enable us to identify and secure the best opportunities for our partners.

SOURCES

- Texas Land Title Association (TLTA) A buyer's guide to title issues and mineral rights

- Texas A&M University - Real Estate Center Publications on the Texas land market and mining rights

- American Association of Professional Landmen (AAPL) Information on industry standards and mineral title searches

Trend analysis

The Texas mineral rights market is rapidly becoming more complex. With the rise of shale mining, more and more owners are looking to monetize their rights. This development is forcing buyers to verify their titles even more rigorously before any purchase.

FAQ : QUESTIONS YOU MAY HAVE ABOUT MINING RIGHTS IN TEXAS

1. How does buying land in Texas affect mineral rights?

When you buy land in Texas, you don't automatically get the mineral rights. The surface title and the mineral title often appear as two separate items. Always check the deed to confirm the inclusion of mineral rights. This is a crucial point of vigilance.

2. How can I check whether a plot of land has active mineral rights?

To check whether a piece of land has active mineral rights, you need to hire a professional (specialist lawyer or "landman") to carry out a mineral title search. They will examine county records to find deeds and mineral leases associated with the property.

3. What is royalty and how do I get it?

A royalty is a payment you receive from a company for mining minerals on your land. To receive it, you must own the mineral rights and sign a mining lease with the company. Valuing these royalties can be complex.

4. Are mineral rights still fragmented?

Owners sometimes fragment mineral rights, but this is not systematic. Ownership history and past transactions determine this situation. One individual may hold a mineral right in its entirety, or share it with numerous heirs. That's why you should always carry out a title search.

5. How do I find a Texas mining lawyer?

Contact the StateBar of Texas to find a lawyer specializing in mining rights, or ask for referrals from professional associations such as the Texas Land Title Association. Lawyers practicing in areas of high oil activity, such as Houston or Midland, generally have the most experience.

6. Is it risky to buy land without mineral rights?

Buying land without mineral rights doesn't necessarily pose a risk if you act with full knowledge of the facts. The real danger arises when an exploration company lands on your property without your knowledge. Knowing the exact status of your mineral rights allows you to correctly assess the real value of your property.

CONCLUSION AND CALL TO ACTION

The Texas real estate market offers many opportunities, but also imposes unique challenges. Investors often overlook Texas mineral rights, even though they directly influence a property's value and usefulness. As we've shown, only due diligence effectively protects your interests. If you ignore mineral rights verification, you risk turning a promising investment into a money pit.

To sum up, here's what you need to remember:

- Land ownership is often divided: soil and subsoil are two separate things.

- Verification of mining title is non-negotiable: Never trust appearances

- Royalties can be a source of income: But only if you own the mineral rights.

To answer our original question directly: you need to consider mineral rights not as a detail, but as the heart of your transaction. They can be the most valuable asset of your purchase.

🎯 Ready to invest in Texas?

Contact LandQuire and benefit from expert support to secure your mining rights. Our team of land entitlement experts will support you at every stage of your investment.

Share this article with other investors to help them avoid costly mistakes in this complex market.

This article was written by the LandQuire team of experts, specializing inland investment in Texas since 2021.

This content is provided for information purposes only. It does not constitute legal advice. Consult a Texas attorney before making any decisions.

📚 Also read:

- International Taxation: A Comprehensive Guide - Understand how global taxation affects your property investments.

- Tenant Owned Home: a profitable real estate strategy in the United States - Find out why this investment model is attracting more and more investors.

At LandQuire, we place transparency at the heart of our approach. This is part of what makes us different, and forms the basis of the relationship of trust we build with each investor.