Investing in real estate in Brownsville, Texas: an opportunity to seize before 2026

Real estate investment in Brownsville, Texas , is attracting a new waveof French-speakinginvestors. This city in southern Texas is undergoing a rare transformation. It remains affordable despite explosive growth. SpaceX is investing billions. The port generates $12 billion in business. Demand for housing is skyrocketing. As a result, land values are rising rapidly.

📌 Why Brownsville is a game changer for investors

In a market where truly ready-to-develop land is becoming scarce, Brownsville combines three rare drivers: SpaceX, a rapidly expanding port, and a rapidly growing young population.

LQ18 fits perfectly at the intersection of these trends: off-market land, acquired at $31,000 per acre, where the market is trading between $45,000 and $50,000 for comparable plots.

Author

This article was produced by the LandQuire team. LandQuireteam, which specializes in real estate investment in the United States. Our experts assist French-speaking investors in their acquisitions of American land.

🔗 Follow LandQuire on LinkedIn

📞 Specialized contact in Texas

Why Brownsville is so attractive to investors today

Brownsville has a population of 193,000. The median age is 31. This young population forms new households every year. They buy, build, or rent. The problem? Real estate isn't keeping pace. Brownsville is located in Cameron County, in the southernmost part of Texas, on the border with Mexico.

SpaceX is changing everything in the region

SpaceX employs more than 4,300 people at Starbase. This number is increasing every month. The FAA authorizes 25 launches per year. Each launch attracts 10,000 visitors. This activity creates a massive need for housing.

When a company of this size sets up shop, everything changes. Engineers arrive with high salaries. They want to live near the site. Businesses develop. Land automatically increases in value.

SpaceX has invested more than $3 billion. The benefits are felt throughout the local economy. The hotel, restaurant, and service industries are direct beneficiaries. This momentum is supporting real estate demand.

Port of Brownsville speeds up demand

The Port of Brownsville generates $12 billion in business. More than 770 acres of industrial land are under development. These projects are creating thousands of jobs. Workers, technicians, and managers are flocking to the region.

Everyone is looking for housing. Everyone needs affordable land and communities. The gap between supply and demand is becoming apparent. Builders are struggling to keep up.

A city that is still affordable, but not for much longer

The median home price is $255,000. That's still low for Texas. Austin exceeds $550,000. Dallas exceeds $400,000. Brownsville remains an entry-level market.

But this window will not last. Data from the U.S. Census Bureau confirms continued growth. The cost of living remains 15% below the national average. This affordability attracts new residents every month.

The real estate market: accessible but under pressure

Brownsville lacks developed land. Builders are looking for ready-to-build lots. They want to produce quickly. But they don't have enough inventory.

Land that is truly ready for development is rare. When a plot ticks all the boxes, it leaves the market within days.

In this market, as soon as a plot of land is ready for development, it sells quickly. Builders purchase dozens of plots at a time. This explains why an opportunity like LQ18 stands out from the crowd.

In a market where developable land with water and sewer connections is sorely lacking, LQ18 immediately stands out. LandQuire has managed to secure off-market land in the heart of Brownsville before institutional investors move in en masse. Opportunities like this rarely come along... and disappear quickly.

Why is it so scarce? Since 2008, American developers have almost stopped buying land themselves. They wait for specialized companies like LandQuire to do the legal, technical, and administrative work. As a result, demand far exceeds the supply of land ready for development.

Here's what that means for you. When an investor develops a well-located subdivision, everything sells quickly. Builders buy entire lots. The market quickly absorbs simple projects.

National shortages reinforce local effects

The United States has a shortage of between two and six million homes. Texas needs to triple its housing starts. This structural shortage creates a rare opportunity. Well-located land is rapidly increasing in value.

Domestic builders are entering the market in droves. They are looking for inventories of lots ready for development. Discover all our land listings in the United States.

LQ18: a concrete example of investment in Brownsville

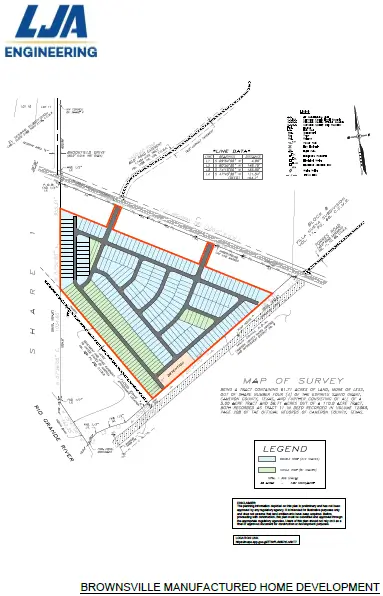

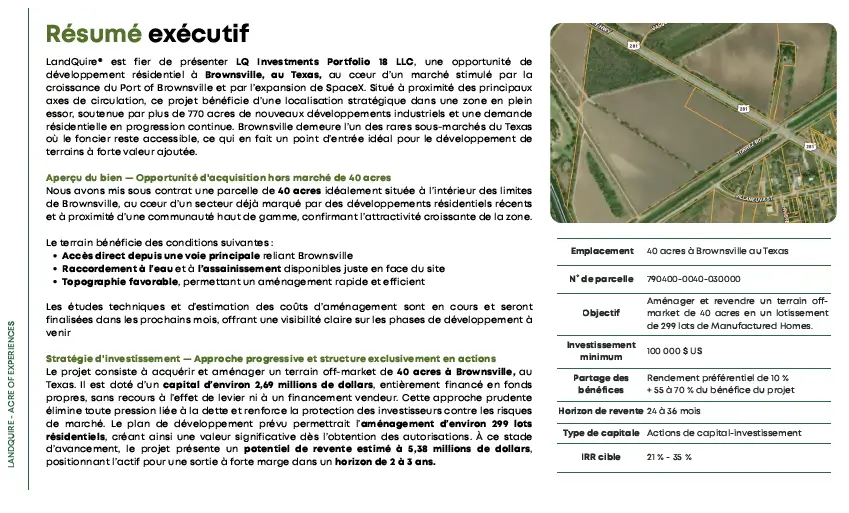

The LQ18 project perfectly illustrates the market's potential. LandQuire has acquired 40 acres in Brownsville itself. The goal is clear: to create 303 residential lots. This format corresponds exactly to local demand.

Land acquired off-market

These lots are designed primarily for manufactured homes and mobile homes, i.e., affordable residences where families can become homeowners while leasing the land. This type of residence already has an occupancy rate of over 95% in Brownsville, indicating massive and sustained demand.

To give you a better idea: 1 acre is equivalent to approximately 4,047 m².

So 40 acres is almost 160,000 m² — the equivalent of more than 20 football fields side by side.

LandQuire negotiated directly with the owner. This type of purchase often allows for a significant discount. This margin protects investors from the outset. It increases the potential for final returns.

Why is LQ18 such a rare gem?

LandQuire has analyzed the market in detail:

• 5,000 offers sent on Brownsville

• Only one truly viable opportunity

• Purchased off-market

• With water + sewer

During sourcing, the team compared actual market prices on LoopNet and Zillow. The result: it was impossible to find land with water and sewer connections for less than $45,000 per acre, and often more. The current range is between $45,000 and $50,000. This discount on the purchase price automatically secures the project.

Result: land acquired at $31,000 per acre, while the market price for comparable land is closer to $45,000–50,000 per acre.

The land is strategically located. It is close to major roads. Water and sewerage networks are available. The topography is favorable. Development will be rapid and controlled.

100% equity structure: maximum security

Financing is based solely on equity capital. No bank loans. No leverage. This choice greatly reduces risk. It allows for greater flexibility in terms of timing.

The minimum investment is $100,000. Investors receive a preferential return of 10% per annum. They then receive 55% to 70% of the total profits. This structure protects passive investors.

Projections based on recent sales

The gross resale value is estimated at $5.38 million. This projection is based on verifiable comparables. Similar lots sell for between $16,000 and $20,000.

The target IRR is between 29% and 35% over 24 months. Obtaining plat approval transforms raw land into a premium asset. Builders are already waiting for these lots. This pre-identified demand secures the exit.

A "paper lot" is simply a lot that has already been approved by the city but not yet built. The permits have been validated, the subdivision is official, and the builder can start immediately. It is this administrative authorization that creates a large part of the value.

Why the window closes at the end of 2025

Fundraising closes in December 2025. Here's why this deadline is crucial.

Land prices are rising rapidly. Every month of delay reduces margins. Off-market opportunities are becoming scarce. Institutional investors are discovering Brownsville.

The longer you wait, the more you'll pay. Investors who position themselves in 2025 will benefit from the best conditions. Those who wait until 2026 will pay the market premium.

Three types of land opportunities in Brownsville

Each strategy corresponds to a different profile. Here are the three most common ones. Flat topography significantly reduces costs and speeds up construction. This is a rare advantage in Brownsville.

1. Raw land to be developed

They offer the highest value creation. But they require real local expertise. Access, topography, and networks determine everything.

To analyze raw land, consider three simple questions. Can I access it via a paved road? Are water and sanitation facilities nearby? Does the zoning allow for my project?

If you check these three boxes, you're off to a good start. Next, technical studies will refine the analysis. The survey will define the precise boundaries. The soil study will reveal the quality of the land.

2. Approved subdivision lots

This strategy remains the preferred option for developers. Lots sell quickly. They do not require physical construction. The value lies in the platting permit.

The cycle lasts between 24 and 36 months. Obtaining municipal permits transforms the land. Approved paper lots immediately find buyers. This approach minimizes construction risks.

3. Mobile home communities

Demand is skyrocketing in Texas for this segment.

- Families are looking for affordable solutions.

- Development costs remain low.

- The exits are fast.

In Brownsville, mobile home parks are already operating at around 95% occupancy, demonstrating the depth of local demand.

LandQuire has already sold several MHP projects. ROIs have reached 63% to 85%. Clearly, these homes meet a real need. This demand supports long-term returns.

What to check before buying land

Here is a simple checklist. It allows you to assess the real potential of a plot of land.

✔️ Strategic location

Prioritize land close to major transportation routes. Aim for less than 20 minutes from employment areas. SpaceX, the port, and industrial areas are driving demand.

The proximity of existing developments validates the market. This information tells you where to buy before others do.

✔️ Zoning and permits

Verify that the land allows for your intended use. Platting validates the division into lots. This process takes 6 to 12 months in Brownsville.

Check the municipal zoning plan. The Texas Real Estate Commission provides useful resources.

✔️ Available utilities

Water at the property line changes everything. It reduces connection costs. Municipal sewerage often doubles the value.

Electricity must be accessible. The cost of extension can reach several thousand dollars. These details determine the final profitability.

✔️ Risk of flooding

Check the FEMA maps at MSC.FEMA.gov. Zone X remains ideal for development. It is not classified as a major flood zone.

Approximately 38% of properties are at risk of flooding over a 30-year period. This data requires a plot-by-plot analysis. Without this verification, you are playing Russian roulette.

Taxation for French-speaking investors

Here's what you need to know. Your tax advisor will take care of the rest.

FIRPTA imposes a 15% withholding tax on the sale. You can claim back the difference when you file your tax return. Texas does not levy any state tax on capital gains. This is a huge advantage.

The LLC structure simplifies everything

A LLC facilitates taxation for non-residents. It also simplifies inheritance. For a French investor, this format remains the most common.

Capital gains are taxed at the federal rate only. This rate varies between 15% and 20%. The absence of state tax preserves your margins.

Are you French? You are not affected by SB17.

Texas implemented restrictions in September 2025. Senate Bill 17 targets four specific countries. French investors are not affected. You can buy freely. Period.

Risks to be aware of before investing

All investments involve risks. The important thing is to understand them.

Market risks

Brownsville is partially dependent on SpaceX. A reduction in activity would impact the market. However, the port and industry are diversifying the economy. Population growth is supporting long-term demand.

Regulatory risks

Zoning can change with urban planning. Experienced local support reduces this risk. LandQuire cultivates relationships with local authorities. These connections facilitate approvals.

Environmental risks

Some areas are prone to flooding. FEMA maps identify these areas. A detailed study avoids problematic plots.

Liquidity risks

Land sells more slowly than houses. But developed lots find buyers quickly. Builders remain the natural buyers. The 24- to 36-month cycle remains standard.

Clearly, land remains less liquid than an apartment, but it benefits from natural appreciation over time, especially when it is purchased at a discount and developed like LQ18.

LandQuire support from A to Z

LandQuire simplifies real estate investment for French speakers. We handle all the complexities of the U.S. market.

Our team identifies off-market opportunities. We negotiate directly with owners. This approach secures significant discounts.

We carry out all the necessary technical studies. Surveys, soil studies, environmental analyses. These checks protect against unpleasant surprises.

We manage the process of obtaining municipal permits. Platting, connections, approvals. This expertise speeds up projects and maximizes returns.

Investors receive regular reports. They monitor progress in real time. This transparency has characterized our approach since 2021.

Our 145 transactions in the United States demonstrate our expertise. We have generated an average IRR of 22%. This experience helps us avoid common mistakes.

FAQ: frequently asked questions

What is the minimum amount required to invest?

Tickets start at $100,000 at LandQuire. This amount allows risks to be pooled across professionally managed projects.

How long does a land project last?

The cycle lasts between 24 and 36 months. Six to twelve months for authorizations. Twelve to eighteen months for marketing.

Can a French citizen buy freely?

Yes, absolutely. Senate Bill 17 does not apply to French investors. You are free to purchase land.

What returns can be expected?

Subdivision strategies often target IRRs of over 20%. The LQ18 project targets 29% to 35% over 24 months. Each project has its own profile.

Do I need to travel to the United States?

No, it is not mandatory. LandQuire manages all operational aspects. You invest from France. Documents are signed electronically.

Conclusion: act now or watch the opportunity pass you by

Brownsville has all the ingredients for a winning market. Rapid growth. Strong demand. Land that is still affordable. A clear window before 2026.

- Prices are gradually increasing.

- Institutional investors are discovering this market.

- Off-market opportunities are becoming increasingly scarce.

The LQ18 project illustrates this potential. 303 lots planned. 100% equity model. Clear and secure framework. The fundraising campaign closes at the end of 2025.

Smart investors act while others analyze. The question isn't whether Brownsville will grow. The question is whether you'll position yourself before or after.