Seguin land investment: Portfolio 17 in 24-36 months

Local context & thesis: Portfolio 17 at Seguin

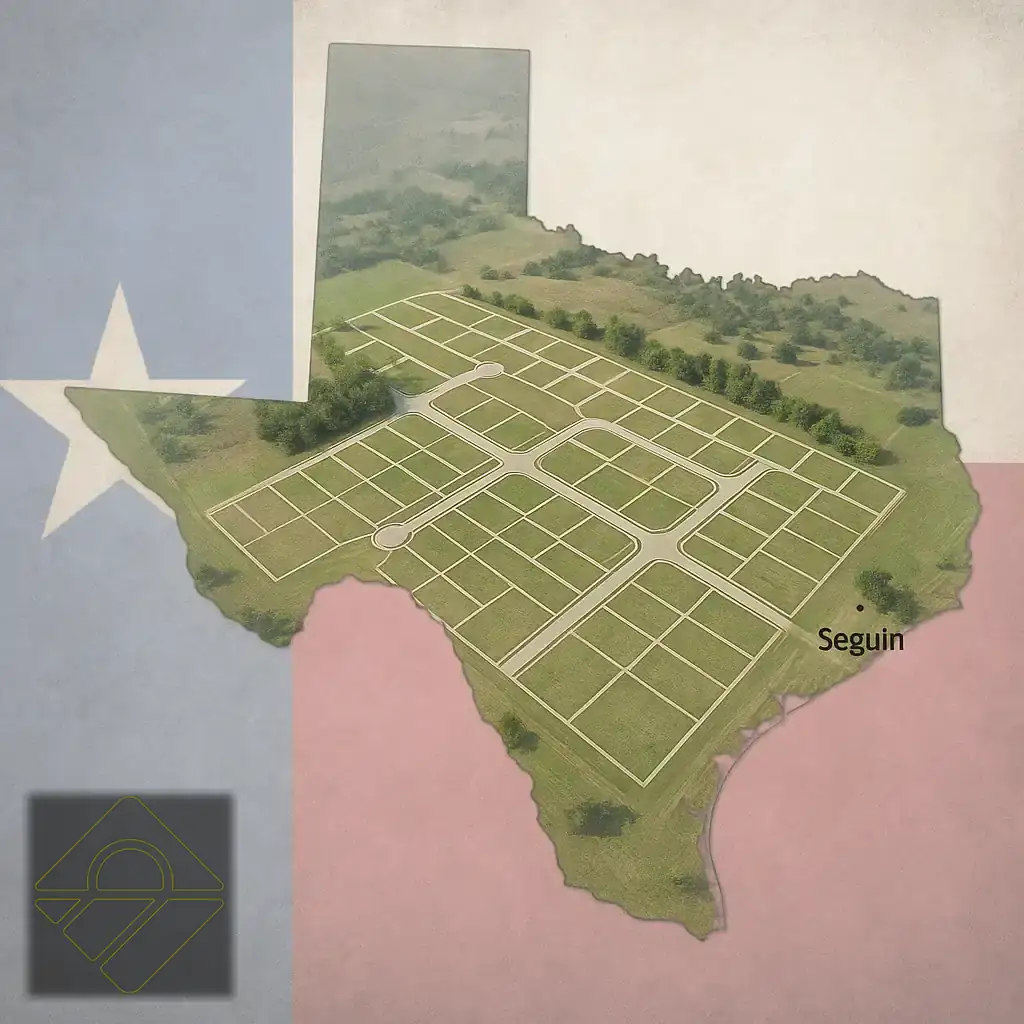

Land investment in Seguin: south of Highway 46, 30 minutes from San Antonio, LandQuire launches Portfolio 17 - a 97-acre asset aimed at creating around 140 residential lots, with an exit strategy in 24-36 months. Clear thesis: buy at a discount (approx. $10,000/acre), create value through entitlement (permitting + "plat"), then arbitrate between a sale in paper lots (phase A) or finished lots (phase B) depending on market conditions. For the investor, the scheme combines a preferential return of 10%/year with margin sharing (55-70%), in a debt-free framework designed to better control risk.

🔹 Welcome to LandQuire

At LandQuire, we believe that property investment shouldn't be reserved for an elite few. That's why we put a highly qualified team at your disposal, combining expertise in real estate, technology and data analysis, to support you every step of the way. 👉 Check out our latest news on LinkedIn.

to remember

- Location: Seguin (Guadalupe County), 30 min from San Antonio - San Antonio ↔ New Braunfels ↔ Austin corridor.

- Purchase discount: target approx. $10,000/acre vs. regional comparables often ≥ $20,000/acre.

- Value creation: approx. 162 lots (front/flag lots), 12 months permitting, approx. 90 days VRD if phase B.

- Two exit options: phase A (paper batches) or phase B (finished batches).

- Deal economics: 10% prime/year + 55-70% margin, 24-36 month horizon, zero debt.

- Ticket: min. $100,000 (52% at signing, 48% at 12 months if phase B).

1) Why is investing in land in Seguin attractive in 2025?

Located in the dynamic metropolitan area of San Antonio (7ᵉ city in the U.S. by population according to the U.S. Census Bureau), Seguin is catching the Texas demographic and economic shockwave: positive net migration, competitive land costs, expanding infrastructure and residential attractiveness. Neighboring New Braunfels has posted one of the strongest recent growth rates according to Texas Demographic Center data; Seguin is following the same trajectory, supported by public projects (roads, parks, downtown) and the arrival of private players.

Why does it matter for a residential development in Seguin?

Investing in Seguin land offers several competitive advantages:

- Median housing prices still lower in Austin/Dallas/Houston, reinforcing household absorption capacity.

- Institutional land is still accessible around San Antonio, making it possible to buy large and at a discount, then densify.

- Short permitting cycle in Texas for this type of asset: 9-12 months observed on comparable projects, based on the official process of the City of Seguin (Planning & Development Services).

Local context 2024-2025

The San Antonio-New Braunfels-Seguin basin attracts households and businesses thanks to a lower cost of living than other Texas metropolises, and an employment base driven by industry, logistics and services. In Seguin, the town council has refocused its efforts on roads, modernizing facilities and digitizing the urban planning process, which makes it easier for entitlements to be filed. The SH-46/I-10 corridor effectively links Seguin to the New Braunfels and San Antonio employment hubs, with land still competitive in 1ʳᵉ/2ᵉ crowns. For investors, this translates into robust absorption capacity (affordable median price, builders' appetite for ready-to-build lots) and a potentially shorter time-to-market than elsewhere in Texas. This context - infrastructure, urban planning window, buyer demand - reinforces the A/B logic: arbitrate between paper lots and finished lots according to market conditions.

2) Assets: 97 acres → ~140 lots

- Perimeter: ~97 usable acres, fairly flat topography, clear access, out of flood zone according to preliminary FEMA analyses.

- Town planning/entitlement Target: 162 residential lots (mix of front lots and flag lots). Indicative target exit prices :

- Front lots: ~$72,500

- Flag lots (rear): ~$62,500

- Utilities & VRD: road/electricity/water extension over ~90 days after the "flat" is obtained if the project goes to phase B (finished lots).

- Engineering: partner LGA (San Antonio office), renowned for keeping to budgets and milestones.

Geolocation & accessibility

The site is located on the south side of SH-46, around 30 minutes from San Antonio, with easy access from major roads (SH-46 / I-10). This location offers a dual advantage:

- Residential: easy commuting, close to schools, shops and everyday services.

- Marketing: attractive to developers looking for standardized lots (front lots) and end buyers seeking 0.5–1 acre plots in an open environment.

During phase B, we carry out connection work (roads, water, electricity) according to a precise schedule. The goal is to deliver land that is ready for construction and meets local needs exactly. For investors, this guarantees a finished, secure product, allowing lots to be resold much more quickly once permits have been obtained.

Worth remembering - The asset ticks all the right boxes: discount on purchase, controlled densification potential, limited VRD capex and flexible exit window (A or B).

3) Seguin land investment strategy: creating value on purchase

Investing in land in Seguin is structurally less expensive than in the saturated Austin or Dallas markets. This opportunity can be explained by :

- Achat décoté : Les comparables fonciers à Seguin et alentours se raréfient < 20 000 $/acre pour des surfaces similaires. Pour l’étalonnage des prix/volumes fonciers, se référer aux tableaux TRERC (Texas A&M) et aux fiches du Guadalupe Appraisal District (contrôle cadastral). L’équipe d’acquisition a sécurisé env. 10 000 $/acre, soit une décote significative.

- Forcing appreciation: Entitlement (permit, official "plat") creates value by transforming a large tract of land into marketable lots.

- Maximizing the exit At the end of the 12-month licence period :

- Phase A (paper lots) if an interesting bulk offer is received;

- Phase B (finished lots), if the contract calls for a ready-to-build product (external works completed).

Assumptions & sensitivities

Basic assumptions. The plan targets approx. 162 lots (front/flag mix), subject to the usual adjustments following feedback from Planning andEngineering. Indicative prices differentiate between front and flag to reflect servicing costs. Target schedule ≈ 12 months of entitlement; in the absence of credible paper lot bids, switch to phase B with VRD ≈ 90 days to deliver finished lots. Financial structure remains unchanged: 10% preferential/year (cumulative until exit), 55-70% of margin above preferential, zero debt.

Reading by sensitivity. Conservative: slightly reduced density, lower price range, horizon around 30-36 months; priority to phase B to capture value per lot. Central: approx. 162 lots, lead times 24-30 months, arbitrage A or B depending on the depth of "builder" demand. Offensive: rapid block supply(phase A, 12-18 months). These projections are not guaranteed and will be adjusted as milestones are reached.

4) Two exit scenarios (A/B) - logic and key figures

| Parameter | Phase A: "Paper" batches | Phase B: "Finished" batches |

|---|---|---|

| Completion point | End allowed ("flat") | Permit + VRD (~90 days) |

| Target audience | Developer/builder (block) | Builder (block) or retailer (cut-to-size) |

| Order of magnitude values | Estimated aggregate resale lower than phase B | Higher estimated aggregate resale (e.g. ~$9.7 M gross evoked) |

| Horizon | ~12-18 months | ~24-36 months |

| Effect on TRI | Shorter = potentially high IRR | Higher gross value but longer time horizon |

Important: detailed figures (prices per lot, net values after costs, commissions & contingencies, etc.) can be found in the LandQuire pro-forma and data-room. Returns are projected and not guaranteed.

5) Financial structure of land investment for Seguin

- Target capital: approx. $4.8 million, with a maximum of 35 investors.

- Minimum ticket: $100,000.

- Calls for funds: 52% at signature (acquisition & entitlement), 48% around 12 months later if phase B (VRD).

- Waterfall :

- Preferred yield: 10%/year (accumulative until resale),

- Margin sharing (above preferential): 55-70% for the investor, depending on the ticket.

- Debt: None (pure equity structure), which reduces exposure to leverage risk.

- Temporal security: if, 60 months after closing, the exit has not repaid the investors, 100% of the subsequent margin reverts to the investors (protection clause).

To remember - The scheme combines preferential 10%, attractive margin sharing, zero debt and A/B flexibility, with a 24-36 month target.

6) Operating schedule (indicative)

- M-0: closing & call for funds 52% - launch of studies/entitlement.

- M-1 to M-12: permits (weekly meetings with land planner & lawyers; follow-up via Task Planner).

- Option A: paper batch offer before the end → exit phase A (12-18 months).

- Option B: no relevant offer → call for 48%, VRD (~90 days), then marketing of finished lots → exit phase B (24-36 months).

7) Governance, legal & tax (ready-to-invest)

- Vehicle: units in LQ Investment Portfolio 17 (dedicated SPV).

- LLC US (most frequently used option) - Find out how to create an LLC in the USA :

- Start-up ~$850-$1,000, annual management ~$800-$1,000 (including tax package),

- EIN obtained, USD bank account ( Wise-type solutions) available remotely.

- Reporting: Agora investor portal, quarterly reporting, data-room access (brochure, pro-forma, comparables, contracts).

- Taxation: annual K-1 certificate (US); double taxation agreement USA-France depending on your status (individual/corporate). A personalized review with the tax expert is proposed.

Disclaimer - Tax information is generic and does not constitute personalized tax advice.

8) Market analysis: Seguin land investment vs. regional comparables

Buying at a discount: target ≈ $10,000 per acre where land of comparable area/access can be found higher up, according to reports by the Texas Real Estate Research Center (Texas A&M) and parcel audits by the Guadalupe Appraisal District (consulted on 19/09/2025). These "primary" sources calibrate local orders of magnitude (prices, volumes, trends) and support the discount argument. Micro-market discrepancies depend on the access, topography and technical constraints specific to each tract.

The data-room makes available: purchase contracts, "plat", engineering studies, VRD costings, utility maps, county property card, market comparables.

9) Risks & countermeasures (Risk Management)

- Market risk (rates, builder demand) → Option A/B to match the desired product at time T.

- Execution risk (permits/VRD) → Texas pro-business, 9-12 month schedule targeted, LGA as prime contractor, 10% budget contingency.

- Leverage risk → Zero debt on assets, so no bank covenants or interest pressure.

- Environmental/climate risk → due-diligence checks, insurance (umbrella policy) on assets.

- Investor liquidity risk → unlisted vehicle, 24-36 month horizon; no monthly cash flows (distribution on exit).

Risk → response matrix

Market & rates. Parade: dual exit (A/B) to match current preference (paper lots vs. finished lots), continuous monitoring of comparables and builder intentions during entitlement. Execution (permits/VRD). Parade: weekly governance with engineering/lawyers, budget contingency, calendar buffers, framed calls for tender and quality control at each milestone. Regulatory. Parade: pre-application and early alignment with Ville de Seguin (Planning & Development), exhaustive data-room documentation.

Environmental & technical. Parade: FEMA review, topographical surveys and drainage sizing prior to work, adaptations if necessary. Cost & supply. Parade: firm quotes on precise perimeters, value engineering. Investor liquidity. Parade: recall of unlisted assets, exit distributions, 60-month clause giving priority to investors. Transparency. Parade: quarterly reporting, Task Planner access, risk register updated at each milestone.

10) Team & track-record

- LandQuire: a data-driven vision for responding to the housing crisis with sustainable, scalable land solutions.

- Track-record (aggregate): ~$39m in equity raised, 31 states, 600+ investors, average ticket ~$183k.

- Recent references: TX/FL projects with permits in ~11-12 months, e.g. sales in ~30 months (order of magnitude).

- Project team (excerpts):

- Daniel Charleton (CEO), Romain Daniellou (COO), Thibaut Guéant (CIO),

- Alexandre Thévenet, Willem Van Biezen (Acquisitions), Edouard Brain (CFO), Kazi Arman Ahmed (Data),

- Ingrid Catala, André Sica, Bastien Dureuil, Julien Boutillier, Mathieu Verloove, Pierre Rizk, Paul Fasterling (Investor Relations & Operations).

worth remembering - Clear governance, structured reporting, weekly task-planning with engineering/lawyers, and a core expertise dedicated to Texas residential real estate.

11) Investor journey

- Discovery & pre-qualification with an investor relations manager.

- Data-room access (brochure, pro-forma, comparables, contracts).

- DocuSign signature: PPM + Unit Subscription Agreement.

- Transfer (52% call) within 10 days.

- Onboarding Agora portal + Task Planner access (real-time tracking).

- Quarterly reporting until exit; pro rata distribution of units on resale.

12) Educational simulation ($100,000)

Simplified & indicative assumptions (see pro-forma for details)

- Preferred yield: 10%/year cumulative until exit.

- Margin sharing: 55% (basic ticket; progressive scale up to 70%).

- Appeals: $52 k (M-0) + $48 k (M-12 if phase B).

Scenario A - paper batches (exit 12-18 months)

- Base: capital employed $52k (if exit before 2ᵉ call).

- Exit distribution: 10% preferential + 55% of attributable margin.

- Projected IRR (order of magnitude communicated): up to ~40%/year (not guaranteed).

Scenario B - finished batches (exit 24-36 months)

- Base: capital employed $100 k.

- Exit distribution: 10%/year over 2-3 years + 55% of attributable margin.

- Projected IRR (order of magnitude communicated): ~20-28%/year (not guaranteed).

Note - Returns depend on exit prices, lead times, long costs and fees, and may vary.

13) Positioning the Seguin land investment in a diversified portfolio

TheSeguin investment property offers several distinctive features for a real estate portfolio:

- Macro exposure in Texas (population growth, GDP, jobs) according to the Bureau of Economic Analysis.

- Short/medium-term horizon (24-36 months), useful for smoothing the overall maturity profile of a diversified portfolio.

- Zero debt: an equity-only brick to temper leverage risk in a still uncertain interest-rate environment, according to the Federal Reserve.

Sources & access (consulted on 19/09/2025)

This operation relies on local and federal primary sources, useful for verifying demographics, regulatory framework and entitlement processes: City of Seguin - Planning & Development Services and Development Services Portal; U.S. Census - QuickFacts Seguin; Guadalupe County and Guadalupe Appraisal District (parcel/tax searches); FEMA Flood Maps (flooding); Texas Real Estate Research Center (Texas A&M) for land trends; TxDOT for SH-46 / I-10 projects. Clickable links are provided in section 14 below and in the data-room.

14) Useful external links

- Ville de Seguin (projects & town planning): https: //seguintexas.gov/

- U.S. Census - QuickFacts Seguin: https: //www.census.gov/quickfacts/seguincitytexas

- Texas Real Estate Commission: https: //www.trec.texas.gov/

- Guadalupe County: https: //www.co.guadalupe.tx.us/

15) Frequently Asked Questions

1) Who can invest? Eligible investors based on the documentation submitted (PPM, subscription agreements). The minimum investment is $100,000.

2) Is the preferential 10% paid each year? No: it accumulates and is paid out at the exit, with the return of the capital and then the sharing of the margin according to the scale.

3) Why two cash calls (52% / 48%)? The first finances the purchase/license. The second, 12 months later, is only called if you opt for phase B (VRD → finished lots). When exiting phase A, the second is not called.

4) What if the market turns? The arrangement is debt-free, with two exit routes (A/B) and a 60-month clause giving priority to investors. Prices/IRR remain unguaranteed.

5) Can I invest via a company? Yes, via LLC US (EIN, USD account) - see our complete guide - or via a structure in France/EU (subject to legal/tax advice). A K-1 is issued on the US side.

16) Conclusion: Why choose a residential subdivision with the Portfolio 17

Investing in land in Seguin with Portfolio 17 represents a unique opportunity to capitalize on Texas' growing population. This Texas real estate opportunity follows a simple, disciplined logic: buy at a discount, densify via entitlement, then sell in paper or finished lots according to the optimal window.

Our development project in Seguin ticks all the right boxes (strategic location, bounded public utilities, mastered engineering, zero debt, 24-36 month timetable), with a preferential yield + margin sharing framework designed for investors looking for short/medium-term Texas property exposure.

👉 Talk to a LandQuire manager and access the data-room and pro-forma to simulate your case : Contact a LandQuire expert

📊 A sk for the detailed pro-forma: Pro-forma Portfolio 17

Express glossary

Entitlement - All the planning and platting permits that make lots legally marketable. Paper lots - Lots approved but not serviced. Finished lots - Serviced lots (roads, water, electricity), ready to build. VRD - Voiries & Réseaux Divers: internal roads, main networks and connections. Front lot / Flag lot - Front lot / second line lot, with different service costs. Preferred return (10%) - Priority return paid to investors before any margin sharing. Waterfall - Rules for distributing profits after preferential return. 60-month clause - If the exit exceeds 5 years after closing, the subsequent margin reverts in full to the investors.

Disclaimers & warnings

This document is for information only and does not constitute a public offer or financial/legal/tax advice.

Any investment decision requires a full reading of the PPM, subscription agreements and pro-forma.

Past performance is no guarantee of future performance; returns are projected and not guaranteed.

The schedule, VRD costs, final density, exit prices and exit horizon depend on market and regulatory factors that may change.

4 thoughts on "Seguin land investment: Portfolio 17 in 24-36 months"