Red flags before buying a Red Flags property: what you absolutely must check

understanding Red flags before buying land

Red flags before buying land are more common than you might think. Ignoring them can turn an attractive land opportunity into a financial nightmare. Each plot of land has its own specificities: some pitfalls appear on the first visit, others only become apparent once work has begun... and then it's too late.

All too often, buyers attracted by a tempting price overlook the technical, administrative or logistical details. Yet it's precisely these Red flags that make the difference between a profitable investment and a never-ending sinkhole. A slope that's difficult to develop, a landlocked plot, inappropriate zoning or the absence of essential network connections: these are all points of vigilance that should immediately alert any serious buyer.

Investing in land is more than just buying a piece of land. It's about anticipating, analyzing and securing. Understanding these Red flags will help you avoid costly mistakes and build a solid, sustainable, value-generating real estate project, especially for French-speaking investors wishing to establish themselves in the United States.

🔹 LandQuire

📌 Romain Daniellou - Co-founder of LandQuire

"Investing in land in the United States means offering yourself a 100% passive model, aligned with the safe-haven value of land. Over $40 million raised and 600+ investors already trust us to secure their assets."

- 👉 Also read on LinkedIn: Discover Romain Daniellou's analysis of the Red flags in Texas

- 👉 Discover : LandQuire

Buying land isn't just about signing a deed. It's a complex process that must take into account topography, access, zoning, connections and the legal environment. Every detail counts. In this article, we'll look at the main red flags an investor needs to identify before making a purchase, illustrated by concrete examples and practical advice.

Topography - one of the first red flags to anticipate

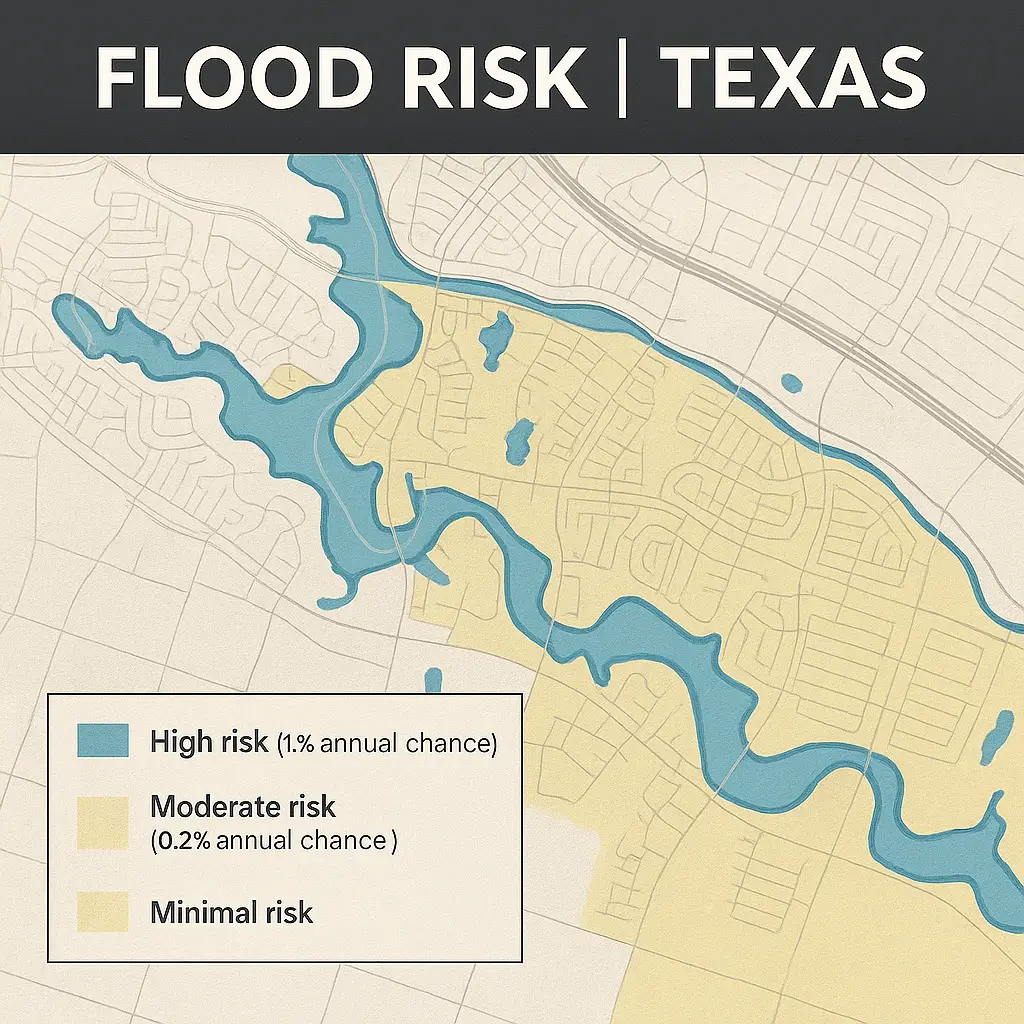

A flat, stable site is the ideal foundation for any real estate project. It facilitates building work, reduces construction time and limits foundation costs. Conversely, a sloping, flood-prone or unstable site can quickly become a financial drain. This is one of the first Red flags to watch out for when making an acquisition, particularly in Texas where certain plains are regularly exposed to flooding.

Why is this so? Because topography has a direct impact on project feasibility and profitability. Too great a difference in level means massive earthworks, costly retaining walls and sometimes even structural adaptations that far exceed the initial budget. In wet or marshy areas, the risk is even more critical: seepage, subsidence, unstable foundations... all Red flags that investors need to anticipate before buying land to avoid loss of value or difficult resale.

In the United States, as in Europe, many investors report having underestimated this factor. They end up trapped with plots of land that look attractive on paper, but are impossible to develop without huge additional costs. Before buying, it is therefore essential to consult official topographical maps and, if necessary, call in a surveyor to obtain a precise study and secure your land project.

Slopes - a frequent red flag to watch out for

- Additional earthmoving costs.

- Difficult access for machinery.

- Complex foundation management.

Flood plots: a common red flag in Texas

- Obligation to invest in drainage systems.

- More expensive insurance.

- Difficult resale due to identified risk.

💡 To remember : Before buying, consult official topographic maps and public databases (e.g. USGS - United States Geological Survey).

Accessibility - a major red flag for investors

An inaccessible plot of land loses much of its value, even if it is strategically located or attractively priced. It's one of the red flags most overlooked by buyers in a hurry to close. Yet, without reliable access, a parcel remains unusable, whether for building, adding value or simply reselling. In Texas, this type of constraint is common in rural areas, where some plots, attractive on paper, actually prove difficult to exploit.

Accessibility is more than just the presence of a paved road. It includes the width of the roads, their state of maintenance, and above all, the ability of construction machinery to travel on them without difficulty. Imagine a residential project where material trucks can't reach the site: logistical costs soar and completion times lengthen. In some cases, the overall profitability of the project can be halved simply because of poorly thought-out access. These constraints are among the essential Red flags to consider before buying a plot of land.

Another critical point concerns the legal status of accesses. Some plots are served by private easements, entailing recurring maintenance costs or potential disputes with neighbors. In other cases, the land is landlocked, with no legal right of way: a situation that can make it totally impossible to use the property.

Before any acquisition, it is therefore essential to check these elements on the land registry and, if necessary, to seek expert advice in town planning or land law. This may seem a secondary step, but it determines the legal and financial security of any investment in land.

Roads and highway access: a red flag to check before buying in Texas

- Check whether the road is public or private.

- Allow for maintenance costs in the case of private easements.

Access to construction equipment: a technical warning signal for investors

A plot of land may look perfect on plan, but if trucks, bulldozers or construction equipment can't access it easily, your costs will skyrocket. This is one of the Red flags that is often underestimated: many investors rely on cadastral documents or aerial photos, without measuring the logistical reality of the site. Without suitable access for heavy vehicles, every step of the way - from earthworks to the supply of materials - becomes a costly headache. In Texas, this problem is common in rural counties, where some plots are attractive on paper but inaccessible in practice.

The financial consequences are immediate: the use of smaller, and therefore more expensive, machinery, doubling or tripling of construction times, and additional labor costs. In some cases, it's even necessary to create a temporary access road, the cost of which can run into tens of thousands of euros or dollars, depending on the nature of the site and its location. This type of logistical constraint is one of the unavoidable Red flags, as it greatly reduces profitability and can block a real estate project before it even gets off the ground.

This problem is frequently encountered in rural areas or urban expansion zones. A narrow road, a sharp bend in the road, a low-tonnage bridge: these are all obstacles that can turn a great land opportunity into an almost unbearable project.

Before you buy, it's essential to carry out an accessibility test with a building and civil engineering professional. This is the only practical way to check whether the land is really usable, without risking major additional costs right from the start of the project.

💡 To remember : Always ask to visit the plot with a construction professional before buying.

Zoning - a legal red flag to analyze before buying in Texas

Zoning defines precisely what you can - or cannot - build on a given plot of land. This is one of the most important Red flags to analyze before buying, as a simple omission can block your entire project. In practice, each municipality or county applies its own rules: some zones are strictly residential, others are reserved for commerce or industry, and there are also mixed zones allowing several uses.

Ignoring this point can have disastrous consequences. An investor wishing to build a residential property in a sector classified as industrial will immediately come up against an administrative refusal. Conversely, land in an agricultural zone cannot be transformed into a subdivision without a complex zoning change procedure, which is long, costly and with no guarantee of success. In some U.S. states, notably Texas, this procedure can take from 12 to 24 months and require several technical studies, adding considerably to delays. These constraints are among the major Red flags that need to be identified to preserve the profitability and legal security of a real estate project.

In the USA, the zoning system is particularly rigorous: plans are public, often available online, but their interpretation requires real expertise. In France, the Plan Local d'Urbanisme (PLU) plays a similar role, and failure to comply with it can result in sanctions, additional administrative costs or an outright ban on building.

Different types of zoning: Red flags to anticipate in Texas

- Residential: ideal for single-family homes or housing estates.

- Commercial: shops, offices, hotels.

- Industrial: factories, warehouses.

Consequences of a bad check: red flags block a project in Texas

- Impossible to build the planned project.

- Costly administrative procedures to request a zoning change.

💡 To remember : Consult your city or county planning department. In the United States, this data is often available online (e.g. Zoning ordinances - American Planning Association).

Connections - costly red flags to anticipate in Texas

An unconnected plot of land remains... a simple piece of land, incapable of generating the slightest added value. This is one of the easiest red flags to identify, but also one of the most costly to correct once the purchase has been signed. Without access to essential networks - drinking water, electricity, sanitation and now broadband Internet - no residential or commercial project can be viable in the long term.

Connection costs are often underestimated by buyers. Bringing a power line to the property can cost between $3,000 and $10,000 in the U.S., depending on the distance to the grid. Installing a septic system or digging a well, particularly in rural Texas, requires complex technical work that adds to the initial budget. In some regions, simply obtaining the necessary permits can delay the project by several months, or even more than a year. These constraints are among the unavoidable Red flags, as they can add significantly to the total cost of an investment and compromise its profitability.

If you don't check these points, you run the risk of investing in a plot of land that's impossible to farm. Before committing yourself, it's essential to get a quote from local utility companies, and to put a precise figure on the actual cost of the connection. This step, sometimes perceived as secondary, can make the difference between a profitable project and a money pit.

Checking access to essential networks: a common red flag in Texas

- Drinking water

- Electricity

- Sanitation

- High-speed Internet

Hidden connection costs: financial red flags in Texas

- Connection to the power grid: several thousand dollars.

- Well installation: depends on soil type.

- Septic system: $5,000 to $15,000 depending on region.

💡 To remember : Always ask for a quote from local companies before signing the purchase.

Legal and environmental constraints: often invisible red flags in Texas

Rights of way and easements: common legal red flags in Texas

Some plots of land are encumbered by servitudes: for example, a neighbor may benefit from a right of way over your plot, which immediately reduces the value and operating peace of your property. This type of legal constraint is one of the more subtle Red flags, as it is not always apparent at first glance. Yet it can turn a promising purchase into a source of conflict and financial loss, particularly in Texas, where questions of land rights and easements are common in rural areas.

Servitudes may concern rights of way, but also the use of water, the right to install pipes or building restrictions linked to views, sunlight or the height of buildings. In practice, they limit your freedom to develop and complicate resale, as any new buyer will have to accept them. In extreme cases, they can even prevent you from building according to your original plans. These constraints should therefore be considered as real Red flags when analyzing a plot of land.

To avoid these risks, it is essential to carefully consult the title deeds and request a detailed cadastral survey. A notary or lawyer specializing in land law will be able to confirm the presence and extent of these servitudes. If you ignore this point, you run the risk of sharing the use of your land against your will, and seeing its value fall significantly. In LandQuire's experience, checking these points beforehand is an essential step in securing any investment in land.

Protecting the environment: anticipating ecological red flags in Texas

- Protected areas (forests, wetlands).

- Restrictions linked to local biodiversity.

💡 To remember : Check with the land registry and local environmental agency.

Case study - when an investor ignores warning signs

A French investor bought 10 acres in Texas, seduced by an attractive price and the promise of a future residential subdivision. On paper, the opportunity seemed ideal: strategic location, below-market price and high resale potential. But a few months after the purchase, reality reminded us of the importance of detecting warning signs before signing.

As soon as the first rains fell, the investor discovered that the land was located in a flood zone, making it virtually unusable without costly improvements. Worse still, no water or electricity connections were available in the immediate vicinity, which meant tens of thousands of dollars in additional expenses. Finally, the zoning did not allow residential construction, only agricultural. The process of requesting a change of classification proved long, complex and with no guarantee of success, with a potential delay of 12 to 24 months.

The result: a stalled project, recurring costs to maintain an unused plot of land, and an estimated loss of over $80,000. This misadventure is a perfect illustration of why it's essential to carry out an in-depth analysis of the points to watch before investing in land, especially in international markets where regulations vary widely from state to state and jurisdiction to jurisdiction.

- The land was in a flood zone.

- No connection.

- Zoning change refused.

Result: project stalled, losses of over $80,000.

Why these checks vary according to location

The warning signs are not the same everywhere: a plot of land may seem ideal in one region, but pose serious problems in another. That's why it's essential for investors to integrate the geographical dimension into their analysis. In the United States, for example, certain points of vigilance are specific to each state. In Texas, flood zones are a major hazard, particularly in the plains near rivers. In Florida, it's exposure to hurricanes and swamps that needs attention. In Arizona, limited access to water represents a considerable risk, while in California, strict anti-seismic standards complicate real estate projects.

Similarly, in Europe, constraints vary from one country to another: in France, local urban planning schemes (Plans Locaux d'Urbanisme - PLU) determine buildability and may restrict certain uses. In Spain, coastal servitudes severely restrict land near the sea. In Italy, the protection of historical or cultural heritage may prohibit any modification or construction on certain plots of land. These local specificities are a reminder that the same project may be feasible in one region and totally unfeasible in another.

💡 To remember : a well-informed investor must always adapt his reading grid to the local context. What constitutes a major risk in one place may be secondary elsewhere, and vice versa.

- Texas: flood risks and specific rural zoning.

- Florida: high exposure to hurricanes.

- Arizona: water access problem.

- California: strict anti-seismic standards.

👉 Case in point: Texas Flood Map

Pre-purchase risk mitigation strategies

- Always visit the site in person.

- Hire a surveyor for a detailed study.

- Check legal documents (titles, land registry, zoning).

- Consult local experts (town planning, construction, notaries).

FAQ - Frequently asked questions

What are the main Red flags before buying land in Texas?

Topography (flood zones), accessibility (roads and easements), zoning (residential, commercial, agricultural), network connections, and legal or environmental constraints.

Is it possible to change the zoning of a property in Texas?

Yes, but the procedure is long, costly and uncertain. Depending on the county, it can take 12 to 24 months and require several technical studies before approval.

What documents should I check before buying a plot?

Title deeds, zoning certificates, any easements, and plans for connection to water, electricity and sewerage networks.

How much does it cost to service a lot in Texas?

Electrical hook-up can cost between $3,000 and $10,000, depending on the distance to the grid. A septic system averages between $5,000 and $15,000.

What natural hazards should you watch out for in Texas?

Flooding in the plains, drought in some rural areas, and local hurricanes in the southeastern part of the state.

Conclusion - why spot red flags before buying land in Texas

Buying land means learning to anticipate problems before they arise. Every plot of land may look promising, but behind the attractive exterior often lie invisible constraints. Red flags - unfavorable topography, limited access, restrictive zoning, lack of connections or legal constraints - should never be ignored if you want to avoid turning an investment into a source of losses.

A well-informed investor knows that real estate represents a tangible and lasting safe haven. But this stability only becomes apparent if you choose carefully, checking every detail and surrounding yourself with experts capable of identifying hidden risks. To ignore these steps is to run the risk of seeing a promising project stalled before it has even begun.

The key is to adopt a methodical approach: analyze, compare, consult the right sources and never give in to haste. A well-chosen plot of land becomes a value-generating asset over the long term. Conversely, ignoring warning signs is tantamount to betting on uncertainty.

Before investing, take the time to check every point: it's the best way to turn a simple plot of land into a real asset.

👉 Thinking of investing in the United States? Contact LandQuire today to secure your projects with a team of experts.

🔗 Useful external links :

Also read LandQuire articles:

- Real estate development in the United States: From bare land to profitable project

- Evaluating Texas investment land: essential criteria to avoid making a mistake

👉 To invest without unpleasant surprises, put your trust in LandQuire: transparency, expertise and comprehensive support to secure every land purchase. Investing in land requires rigor and vigilance in the face of multiple Red flags. To avoid them, it's best to rely on an experienced partner. At LandQuire, every opportunity is analyzed, documented and clearly presented. It's the guarantee of buying with confidence and building a solid, lasting asset. Contact us today