Discover the news

Blog / News

Real Estate & Financing,Investing in US real estate,House - Apartment - Land,USA - états-unis - united states

Ag exemption Texas - reduce your property taxes legally

November 6, 2025

Real Estate and Financing,Investing in U.S. Real Estate,Houses - Apartments - Land,USA - United States

The Texas Ag Exemption is vital: it taxes land on its productivity alone, not its market value. This Ag Valuation reduces your property taxes by 85 to 95%, securing your cash flow in the face of urbanization. Master the criteria to avoid...

Real Estate & Financing,Investing in US real estate,House - Apartment - Land,USA - états-unis - united states

Title commitment Texas - Understanding exclusions and exceptions

November 4, 2025

Real Estate and Financing,Investing in Real Estate in the USA,Houses - Apartments - Land,USA - United States

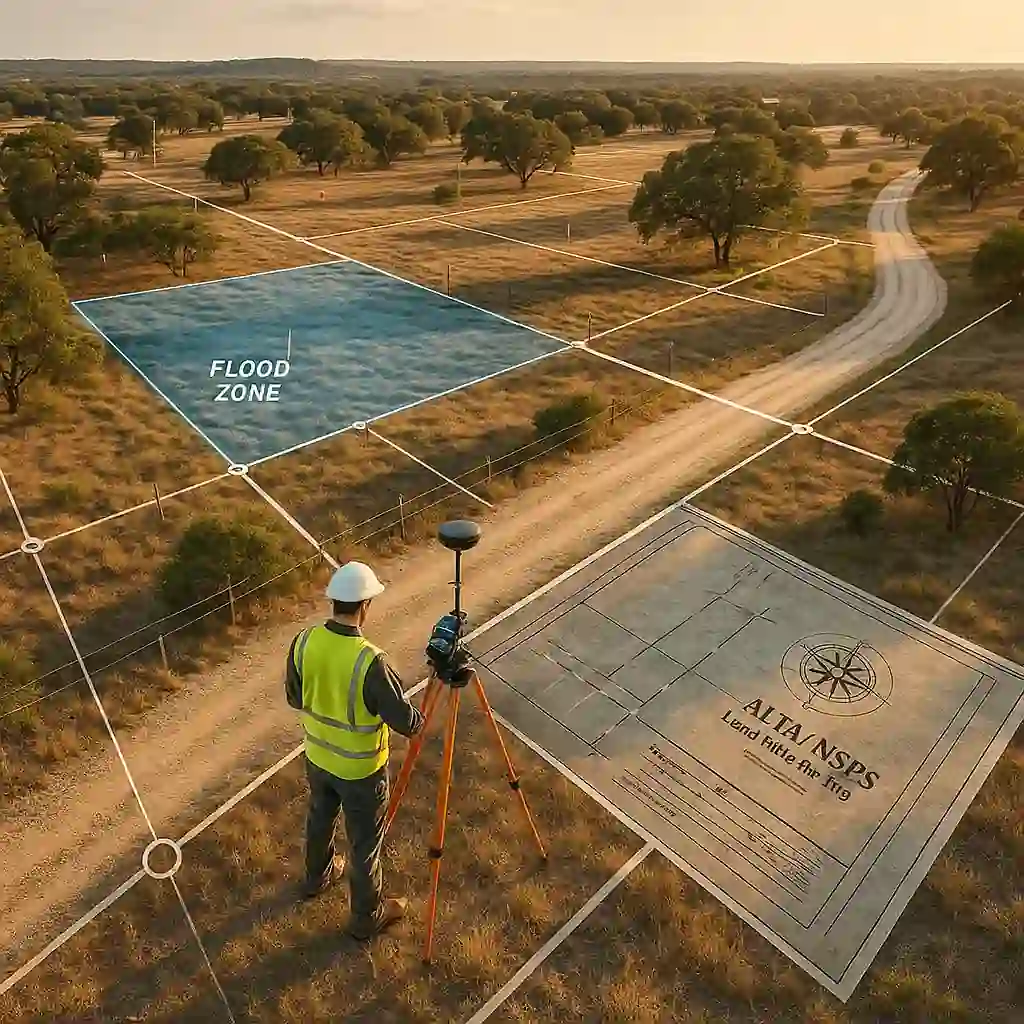

Title commitment Texas: a practical guide to understanding exclusions, exceptions and conditions to be lifted before closing. Optimize your due diligence with ALTA/NSPS surveys, ALTA 9/17/25 endorsements and Objection Letter, to secure access to your...

ALTA land survey: the standard ALTA/NSPS land survey that secures titles, easements, access and FEMA zones. Understand Table A, costs, deadlines and best practices to avoid encroachments, disputes and surprises at closing when buying land in...

October 21, 2025

Investing in Real Estate in the United States,USA - United States

Understanding FEMA flood zones, reading FIRM maps and anticipating BFE helps to assess risk, insurance cost and permit/sale impact. Flood-smart" strategies, DFIRM, NFIP and hydraulic mitigation optimize siting, reduce...

October 9, 2025

Investing in Real Estate in the United States,House - Apartment - Land,USA - United States

Texas water rights: a practical guide to securing your acquisitions. TCEQ, GCD, Watermaster permits, flood and drought risks, costs and key clauses. Checklist, comparison table, timeline, case study and LandQuire contacts to help you decide...

October 7, 2025

Investing in real estate in the USA

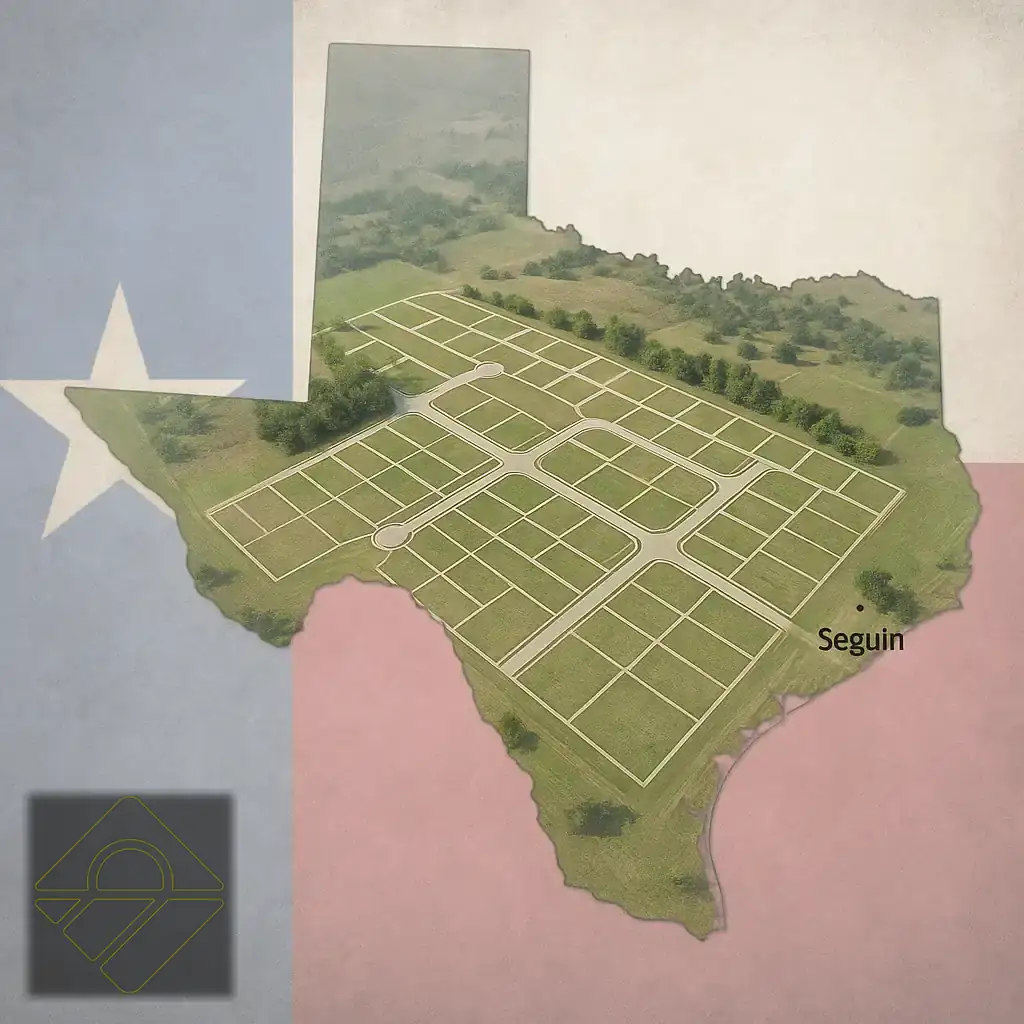

Invest in Seguin, Texas: Portfolio 17 transforms 97 acres into 140 residential lots, with entitlements, targeted VRD and two possible exits (paper lots or finished lots) within 24-36 months. Debt-free structure, 10% preferred/year and shared ownership....

October 2, 2025

House - Apartment - Land,USA - United States

Before buying land in Texas, identify and map your easements: access, utilities, drainage and ROW. Title commitment, ALTA/NSPS survey and contract clauses protect constructability, schedule and budget. Find out more about our...

October 1, 2025

Investing in Real Estate in the United States,House - Apartment - Land,USA - United States

Family Offices Texas: gaining access through proof. LandQuire masters land investment through local entitlement expertise and transparent reporting, guaranteeing secure growth and perfect alignment of interests for...

September 23, 2025

Real Estate and Financing,House - Apartment - Land,USA - United States

Investing in Texas without checking your mineral rights can turn a good purchase into a money pit. Find out how to analyze titles, royalties and contracts to secure your land and protect the true value of your land investment...