McDonald's: a real estate strategy turned into a property empire

McDonald's real estate strategy: the genesis of a property revolution

The McDonald's real estate empire is much more than just a fast-food chain. Behind the golden arches lies a formidable McDonald's real estate strategy that generates nearly $40 billion in property income every year. Contrary to the popular image of a group that thrives solely on menu sales, McDonald's has built a hybrid model in which the restaurant business is merely the façade of an ultra-profitable real estate business.

In effect, each restaurant becomes a strategic real estate asset, carefully selected for its location, accessibility and value-added potential. In this way, McDonald's doesn't just sell hamburgers: the company transforms each location into a real estate investment designed to last for decades. This model offers modern real estate investors an inspiring case study, proving that real wealth often comes from the real estate behind a visible business.

Today, the American multinational owns more than 28,000 plots of land worldwide, making it one of the world's largest commercial property owners. Its power is based on direct ownership of land, which enables it to impose its conditions on franchisees and secure regular income. This unique strategy explains why nearly 75% of the group's sales come from real estate, compared with only a minority share from the restaurant business. In other words, McDonald's has managed to convert a volatile sector into a stable real estate empire, demonstrating the strength of a real estate vision integrated into the heart of a global brand.

AUTHOR

This article was written by the LandQuire team, which specializes in real estate investment in the United States. Our experts analyze the real estate strategies of major corporations to help French-speaking investors acquire American land.

McDonald's real estate strategy: the genesis of a property revolution

The foundations of the McDonald's business model

Ray Kroc, visionary and true architect of McDonald's growth, quickly realized that commercial real estate represented the company's true gold mine. As early as 1955, his intuition changed the Group's destiny. Rather than relying solely on the sometimes low margins of the fast-food industry, he built a unique model: buy strategic land, build restaurants, then lease these locations to franchisees.

This apparently simple mechanism conceals an implacable logic. Each franchisee pays not only royalties on sales, but also ground rent, which is collected directly by McDonald's Corporation. So, even if the local operator struggles to generate profits, the parent company continues to secure stable, predictable income from its property assets. It is this double flow - rent + royalties - that ensures the resilience of the model.

This system has enabled McDonald's to accumulate, decade after decade, a colossal land bank. As Ray Kroc himself explained: " We're not in the hamburger business. We're in the real estate business. " This phrase perfectly sums up the company's philosophy: fast food is just a loss leader, while the real value lies in the land and the walls.

This land strategy has transformed McDonald's into a global real estate empire, capable of competing with the largest specialist groups. For modern investors, Ray Kroc's example illustrates the importance of thinking beyond the product sold, and building lasting wealth through land.

To remember

📊 McDonald's earns 75% of its revenue from real estate - not burgers!

🏢 $40 billion in real estate assets with an average annual yield of 6.8%.

📍 Key criterion: minimum 20,000 vehicles/day before implementation

This approach generates several competitive advantages:

- Recurring income: guaranteed monthly rents from franchisees

- Land appreciation: long-term land value enhancement

- Quality control: total control of strategic locations

- Financial stability: predictable and regular cash flows

The genius of this strategy lies in transforming a volatile food business into a stable, predictable real estate model.

Land acquisition trends

McDonald's Corporation has gradually built up its real estate portfolio in three distinct phases:

- Phase 1 (1955-1970 ): Systematic acquisition of land for the first restaurants

- Phase 2 (1970-1990 ): International expansion and geographical diversification

- Phase 3 (1990-2025 ): Portfolio optimization and urban repositioning

Today, McDonald's Real Estate Company manages property assets valued at over $40 billion, generating average annual returns of 6.8%.

The financial anatomy of the McDonald's land empire

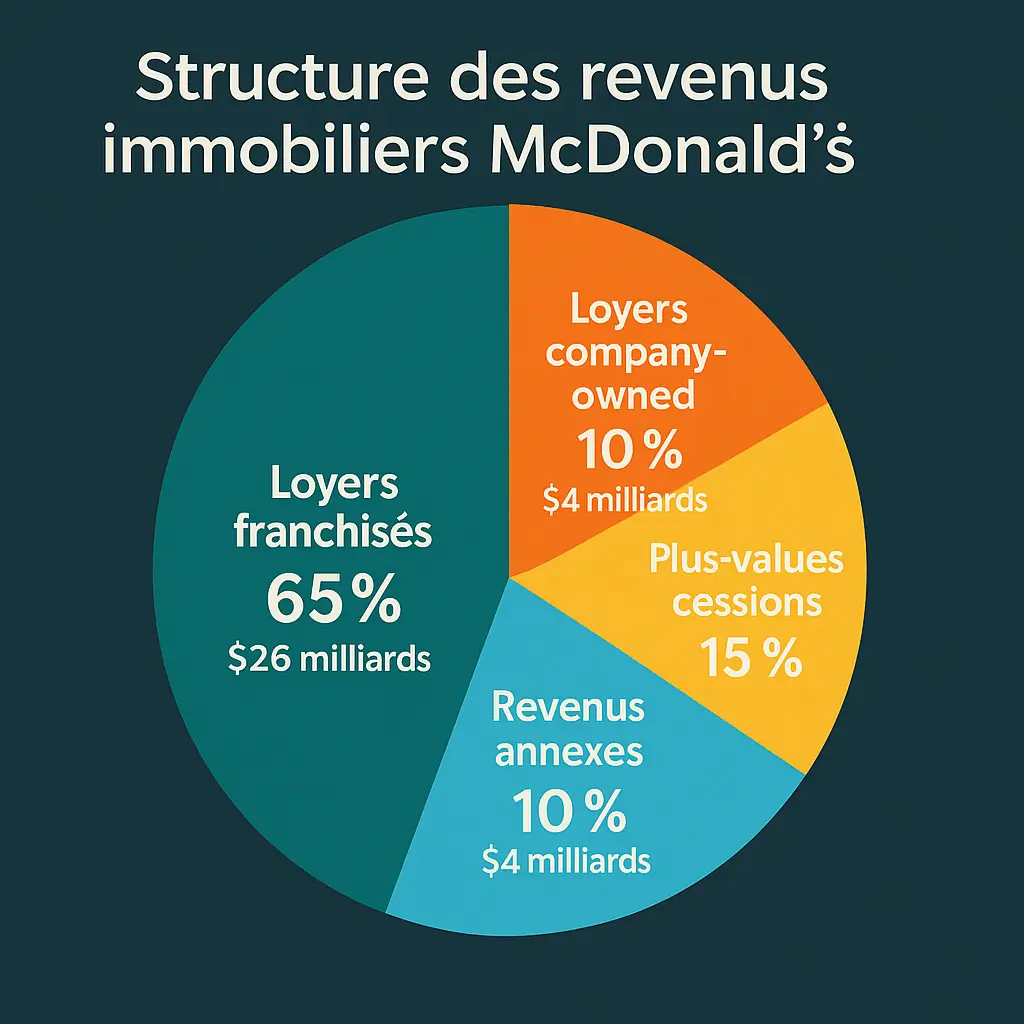

Structure of real estate income

This breakdown demonstrates the predominance of the McDonald's rental model in the company's value generation.

Land profitability mechanisms

McDonald's uses a number of levers to optimize its property income:

Selecting premium locations: McDonald's only invests in high-traffic areas, guaranteeing sustainable rental income. The company meticulously analyzes pedestrian flows, daily automobile traffic (minimum 20,000 vehicles/day), local demographics and urban development projects.

Indexation clauses: The leases include annual revisions based on inflation and franchisee sales. This approach protects McDonald's against currency erosion and ensures steady rental growth.

Tax optimization: McDonald's structures its acquisitions via dedicated real estate companies, thereby optimizing taxation on capital gains and rental income.

Good to know

McDonald's applies the "4 T" rule to its property acquisitions: Traffic (vehicle flows > 20,000/day), Territory (demographics), Timing (passing times), Turnover (profitability). This method guarantees an occupancy rate of 98.5% for the entire property portfolio.

McDonald's acquisition strategies and site selection

McDonald's site selection criteria

McDonald's property investment is based on a rigorous analysis of multiple criteria:

- Accessibility: Proximity to major roads and public transport

- Automobile traffic: Minimum 20,000 vehicles/day on the main route

- Visibility: corner locations or facades on main thoroughfares

- Demographics: Dense residential areas with medium/high incomes

- Competition: Analysis of local market saturation

- Zoning: Regulatory compatibility for commercial activity

This methodology has enabled McDonald's to achieve a 94% success rate on its new sites.

Innovation in land acquisition

McDonald's is continually developing its real estate acquisition techniques:

Institutional partnerships: Collaboration with investment funds and developers to gain access to the best locations prior to public marketing.

Predictive analysis: Using artificial intelligence algorithms to identify areas with high potential for future development.

Group negotiation: Simultaneous acquisition of several plots of land to optimize pricing conditions and reduce transaction costs.

According toINSEE data, McDonald's location strategies are perfectly in line with French demographic trends, with 78% of new restaurants opening in areas experiencing population growth.

Lessons for modern land investors

Adapting the McDonald's model to private investors

McDonald's real estate strategies offer valuable insights for individual investors:

Geographical diversification: McDonald's spreads its risks over several markets, reducing the impact of local fluctuations. This approach is ideally suited to diversified real estate investment portfolios.

Long-term vision: McDonald's holds on to its land for decades, taking full advantage of land appreciation. This strategic patience maximizes returns over the long term.

Recurring income: The McDonald's rental model generates regular cash flows, enabling continuous reinvestment in new acquisitions.

Practical application for investing in the United States

At LandQuire, we adapt these principles to U.S. land investment:

- Rigorous selection of sites according to McDonald's criteria

- In-depth demographic analysis of investment zones

- Long-term holding strategy to optimize value creation

- Geographic diversification across several U.S. states

Today's investors can learn from this approach by targeting commercial land in areas of high population growth. In the United States, three markets in particular stand out: Texas, Florida and North Carolina. These states offer a unique combination of population growth, economic attractiveness and steady migratory flows, making them the perfect environments for property development.

Texas is a perfect illustration of this phenomenon. With dynamic metropolises such as Austin, Dallas-Fort Worth and Houston, the state is experiencing a demographic explosion supported by a competitive cost of living and a business-friendly climate. Investing in Texas commercial land means betting on sustainable demand, particularly in fast-growing residential areas and along major highways.

In Florida, growth is fuelled by the massive influx of retirees, self-employed workers and new families attracted by the tax advantages and quality of life. In cities such as Orlando, Tampa and Miami, demand for real estate is soaring, particularly for locations close to shopping malls, tourist areas and neighborhoods undergoing urban renewal.

North Carolina combines economic dynamism (particularly around Raleigh and Charlotte) with residential appeal. Its young demographics and strategic position on the East Coast make it a high-potential real estate market.

By replicating McDonald's logic - i.e. targeting areas where future demand is guaranteed - private investors can build a solid, profitable property portfolio, while securing recurring income thanks to premium locations.

The pillars of success

🎯 Selection according to McDonald's criteria = Guaranteed profitability

🇺🇸 American market = Exceptional real estate opportunities

📈 Long-term vision = Maximum asset value

Investor and expert testimonials

"After studying the McDonald's model with the LandQuire team, I invested in three commercial properties in Florida. In 18 months, the valuation rose by 23%, confirming the relevance of this land investment strategy." - Marie Dubois, French investor, LinkedIn.

"The McDonald's real estate strategy is a textbook case that we systematically replicate in our US property acquisitions. McDonald's selection criteria guarantee returns in excess of 7% on our customer portfolios." - Daniel Charleton, CEO LandQuire, LinkedIn.

This methodical approach enables French-speaking investors to take advantage of opportunities in the U.S. land market with a proven strategy.

Would you like to apply McDonald's strategies to your property portfolio? Invest in the United States with LandQuire and benefit from our expertise in American real estate to build your land empire according to McDonald's criteria.

The evolution of McDonald's real estate strategy

Adapting to new urban trends

McDonald's Real Estate is constantly evolving to adapt to urban transformations:

Urban repositioning: McDonald's is investing heavily in city centers, gradually abandoning saturated suburban areas. This strategy anticipates changing consumption and mobility patterns.

Innovative formats: Development of compact restaurants for densely populated areas where land is scarce and expensive.

Functional mix: McDonald's is exploring partnerships with developers to integrate its restaurants into complex real estate projects (shopping centers, railway stations, airports).

McDonald's real estate strategy in the face of digitalization

The digital revolution is also transforming McDonald's real estate approach:

- Click & Collect: New layout formats optimized for online ordering

- Delivery: Development of centralized kitchens and relay points

- Drive: adapting terrain to facilitate automotive control

These developments demonstrate the exceptional adaptability of the McDonald's real estate model in the face of rapidly changing consumer trends. The company has never considered its real estate stock to be static: on the contrary, it is constantly adjusting its locations and formats to meet customer expectations and market changes.

The development of the drive-in in the 1980s, followed by the rise of the drive-thru, has profoundly reshaped land selection. McDonald's gave priority to land with good traffic flow, multiple access roads and spacious parking lots. Today, this model continues to evolve with the optimization of vehicle flows and the integration of digital ordering terminals.

The rise of click & collect and home delivery has also influenced land criteria. McDonald's is now investing in locations capable of hosting dedicated kitchens ("dark kitchens") or quick pick-up points, located in the immediate vicinity of dense residential areas. This approach anticipates the rise of e-commerce and home shopping.

What's more, the brand adapts its formats to the constraints of major cities. In saturated urban centers, where land is scarce and expensive, McDonald's relies on compact restaurants integrated into mixed-use projects (railway stations, shopping malls, multifunctional buildings). This enables us to maintain our presence in high-potential areas while optimizing every available square meter.

By combining land flexibility, technological innovation and predictive analysis, McDonald's is proving that a well-managed property portfolio remains a strategic weapon capable of generating sustainable income, even in an ever-changing consumer environment.

International comparative analysis

Model performance by market

The efficiency of the McDonald's land empire varies according to geographic zone:

- United States: Average yield of 7.2% thanks to market maturity

- Europe: 5.8% yield with steady growth

- Asia: 8.4% return driven by rapid expansion

- Other: Yield of 6.1% with high volatility

This analysis reveals the importance of geographical selection in international property investment.

Replication of the model by competitors

Several chains are now replicating McDonald's strategies:

- Starbucks: Acquisition of 15% of its own locations

- Subway: Development of a dedicated real estate subsidiary

- KFC: Partnerships with specialized real estate funds

This widespread adoption confirms the effectiveness of the McDonald's land model and its potential for replication by private investors.

🎯 Winning strategy

McDonald's real estate strategy: 75% of revenues via real estate!

According to a Moz study, companies adopting an integrated real estate strategy outperform their tenant competitors by 34%. These data, corroborated by official annual reports from McDonald's Corporation, confirm the superiority of the landlord model over pure rental.

Ready to duplicate this winning approach? Invest in U.S. real estate with LandQuire - our U.S. commercial land is analyzed according to McDonald's criteria to maximize your land profitability.

FAQ : McDonald's land empire

Why does McDonald's invest so heavily in real estate? McDonald's understands that real estate generates more stable and predictable revenues than the restaurant business. Rents make up 75% of the Group's revenues, offering steady growth and protection against inflation.

How does McDonald's select its locations? McDonald's applies a rigorous methodology analyzing traffic, demographics, competition and development potential. This approach guarantees a 98.5% occupancy rate across the entire portfolio.

Can investors replicate this strategy? Absolutely. McDonald's principles are perfectly suited to private real estate investment: selection of premium locations, long-term vision, recurring income generation and geographic diversification.

What is the average return on McDonald's land? The McDonald's land portfolio generates an average annual yield of 6.8%, with variations depending on geographical markets and types of location.

Conclusion: McDonald's, a land investment model worth replicating

The McDonald's real estate empire brilliantly demonstrates how to transform an operational business into a sustainable real estate investment strategy. This revolutionary approach generates higher returns than traditional financial markets, while offering remarkable stability.

McDonald's lessons apply perfectly to modern property investment: rigorous site selection, long-term vision, recurring income generation and geographical diversification. These principles enable savvy investors to build a solid, profitable property portfolio.

At LandQuire, we support French-speaking investors in applying these proven strategies to the U.S. real estate market. Our expertise enables you to access the best investment opportunities by replicating the methods that have made McDonald's so successful.

🇺🇸 Opportunity USA

Invest in U.S. real estate with the McDonald's method

Ready to develop your own land empire in the United States? Find out how LandQuire takes its inspiration from McDonald's real estate strategy, adapting it with modern, advanced analysis tools to select the best U.S. land and build a solid, long-lasting land heritage. Contact us to find out more.

Sources

- McDonald's Corporation - Financial Information & Annual Reports

- McDonald's 2024 Annual Report

- McDonald's 2023 Annual Report

- McDonald's 2020 Annual Report

- US Census Bureau - Real Estate Statistics

- US Census Bureau - Commercial Real Estate Data

- INSEE - Demographic and economic data

- Moz - Study on corporate real estate strategies

McDonald's is a registered trademark. This article is an independent analysis and has no official connection with McDonald's Corporation.