Discover the news

Blog / News

Land seller contracts allow you to purchase land without going through a bank, thanks to direct financing from the seller. This flexible method appeals to many French-speaking investors in Texas who are looking for speed, security, and more.

January 13, 2026

Investing in U.S. real estate,House - Apartment - Land,USA - United States

Ethical land flipping allows investors to invest in US real estate by combining transparency, compliance, and real value creation. This approach protects margins, strengthens reputation, and reduces legal risks for investors...

January 8, 2026

Real Estate and Financing,Investing in Real Estate in the USA,Houses - Apartments - Land

Landlocked parcels represent one of the most underestimated risks in Texas real estate: isolated land, lack of legal access, inability to build or obtain financing. Understanding the legal solutions is essential for...

January 6, 2026

Investing in U.S. real estate,House - Apartment - Land,USA - United States

Access and frontage determine up to 60% of the actual price of land in Texas. Without legal access or with insufficient frontage, the value drops, permits become uncertain, and costs skyrocket. Properly analyzing these two variables changes everything...

December 23, 2025

Investing in U.S. real estate,House - Apartment - Land,USA - United States

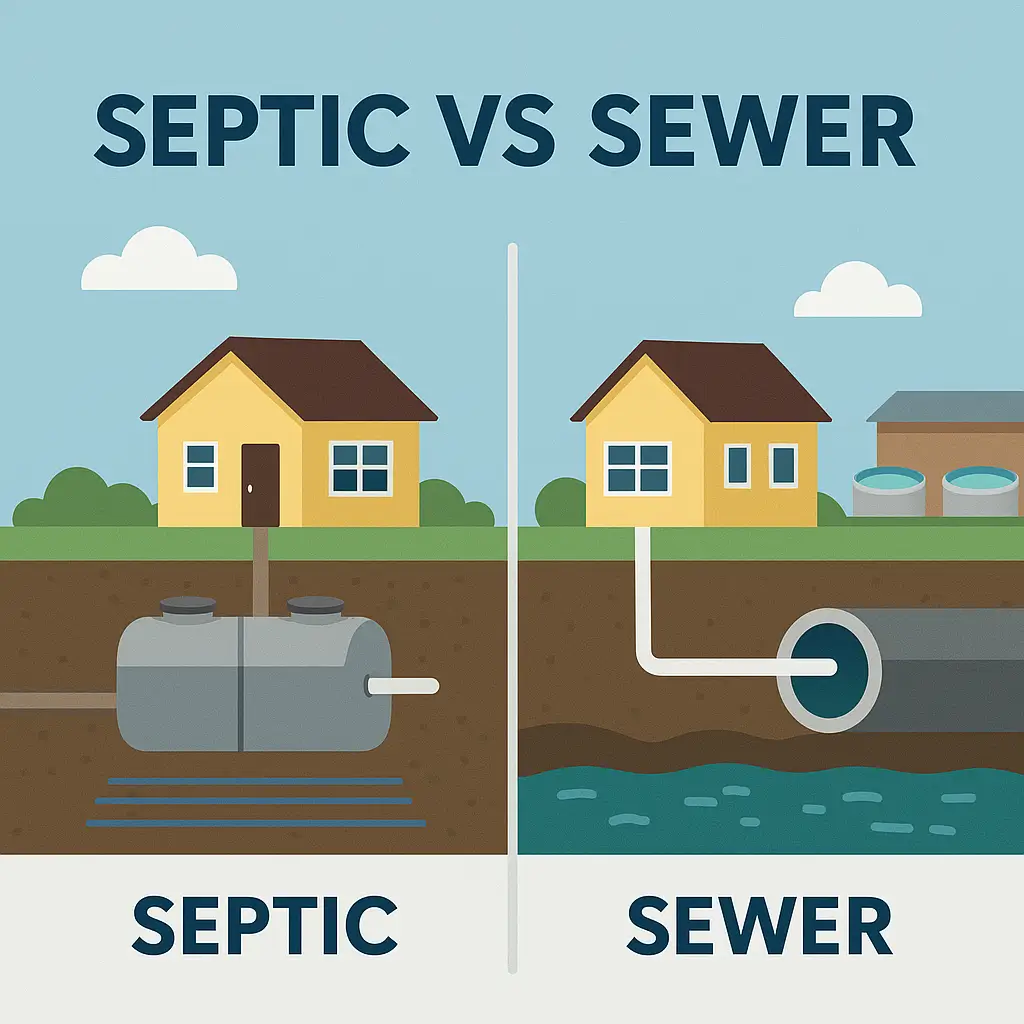

Septic vs sewer determines the feasibility and profitability of land in Texas. Understanding their technical, regulatory, and financial differences helps avoid costly mistakes and optimize every land investment project...

Real Estate & Financing,Investing in US real estate,House - Apartment - Land,USA - états-unis - united states

Subdividing land – procedures, costs, and actual timeframes

December 18, 2025

Real Estate and Financing,Investing in Real Estate in the United States,Houses - Apartments - Land,USA - United States

Subdividing land in Texas requires a rigorous approach and quick decisions. The process covers zoning, surveying, and county registration. Coordinate with engineers and attorneys to validate easements, drainage, and utilities. This transforms...

December 16, 2025

Investing in real estate in the USA,House - Apartment - Land,USA - United States

Land due diligence in Texas protects every investor. It covers titles, easements, mineral rights, natural hazards, and utilities. A comprehensive check ensures a safe, compliant, and profitable purchase, transforming a piece of land into...

December 11, 2025

Real Estate and Financing,House - Apartment - Land,USA - United States

The US land market comps help investors estimate the real value of a piece of land before purchasing it. By comparing recent local sales, they enable investors to set a fair price, avoid costly mistakes, and secure their real estate capital...

December 9, 2025

Investing in U.S. real estate,House - Apartment - Land,USA - United States

The plat approval process defines the official validation of a land subdivision in the United States. This process ensures legal compliance, the viability of lots, and the security of investments. It is an essential step for any...